Spis treści

Poland’s biggest power concern, state-run Polska Grupa Energetyczna (PGE) has recently written off some PLN 9 bln (EUR 2.1 bln) in a revaluation of its key power plants and plans to revise its business strategy. The group will scale down investments, attempt to cut costs and place more focus on the diversification of the fuel mix.

PGE’s two lignite-based power plants in Bełchatów and Turów were the group’s key business assets for a long while. They are still generating solid financial results, but their future has become a source of increasing concern for PGE’s management.

PGE’s two lignite-based power plants in Bełchatów and Turów were the group’s key business assets for a long while. They are still generating solid financial results, but their future has become a source of increasing concern for PGE’s management.

The rising doubts regarding the group’s future performance in the market environment that has been evolving in a disadvantageous direction have significantly reduced the evaluation of power plants using lignite-fuelled generation blocks. As per auditors’ decision, the valuation of the Turów plant and the lignite mine had to be lowered by a whopping PLN 5.1 bln to (EUR 1.2 bln) PLN 445 mln (EUR 105 mln), while the impairment on power plant Bełchatów took its value down by PLN 3.1 bln to PLN 14 bln (EUR 3.3 bln).

Also power and heat facilities were affected: PGE wrote off the entire value of heat and power plants in Bydgoszcz and Kielce (the impairments totalled PLN 577 mln). Previously, the same was done for heat and power plant Zgierz and power facilities complex Dolna Odra (ZEDO). As a result, PGE’s total generation assets value plunged to PLN 20.5 bln from PLN 29.3 bln.

Why is PGE writing off its assets? In a nutshell, contrary to earlier expectations, neither the Polish government, nor PGE have been able to effectively push for regulations, on either the EU or domestic level, that would ensure maintaining a stable profitability of power production from coal. Margins will thus decline.

Brussels is consistently implementing the CO2 emissions reduction policy. As a result, prices of emission rights jumped by 10% in H1 2015 to EUR 7.7. These prices will continue to rise – and at a faster rate. Burning high-emissions lignite is becoming less cost-competitive versus other technologies – not only wind power, which, e.g. at night is competing with some conventional blocks within the system ever more effectively.

Brussels is consistently implementing the CO2 emissions reduction policy. As a result, prices of emission rights jumped by 10% in H1 2015 to EUR 7.7. These prices will continue to rise – and at a faster rate. Burning high-emissions lignite is becoming less cost-competitive versus other technologies – not only wind power, which, e.g. at night is competing with some conventional blocks within the system ever more effectively.

Lignite is also losing the competitive edge over hard coal, the price of which has been falling both in Poland and globally. Hard coal price declines on the domestic market are an outcome of the crisis in the mining industry and the resulting price war. However, PGE management sees more than this year’s turbulence in coal industry behind the loss of the commodity’s competitive advantage and believes it to be a lasting development. The situation is further exacerbated by power price decreases on the wholesale markets in Poland and abroad.

More impairments yet to come?

PGE may be facing further impairments on conventional assets. Even some assumptions on which the group bases asset value revisions are very optimistic or at least difficult to meet. For example, from today’s perspective nothing indicates that PGE’s forecast for 20% electricity price growth by 2020 will materialize. Also the assumption for hard coal prices stabilization at current levels by end-2018 seems risky in the light of some experts forecasting global prices of some USD 35-40 per ton (versus the current level of USD 51/ ton). One may also doubt whether the European Commission will wave through the introduction of capacity market in Poland based on the principles similar to those on the British market, as PGE expects (i.e. a market which supports energy producers and users willing to reduce consumption). Or whether the support for heat and power plants will be maintained throughout the horizon of PGE’s forecast.

A failure to implement capacity market in Poland after 2023 would force PGE to book another PLN 5.2 bln in asset impairments, CFO Magdalena Bartoś said. A potential increase of energy price throughout the forecast horizon would reduce the impairments by PLN 1 bln, while a decline – would raise them by PLN 1.1 bln.

Strategy revision

PGE apparently noticed that the Polish energy market behaves in a manner similar to its German and French counterparts, and decided to revise its strategy adopted as recently as last year. The exact changes that the group will introduce will be announced by the end of 2015. Based on CEO Marek Woszczyk’s declarations, PGE will revise its development plans so as to maximize the efficiency in terms of investments and operational costs. The key investment projects will not be dropped. However, one cannot rule out attempts to sell some assets such as heat and power plants. Moreover, the group will aim to achieve another PLN 1 bln in cost cuts after 2016. To date, reducing expenses at mines and power plants suffering from excessive employment has been one of the weak points of the four state-run Polish power concerns.

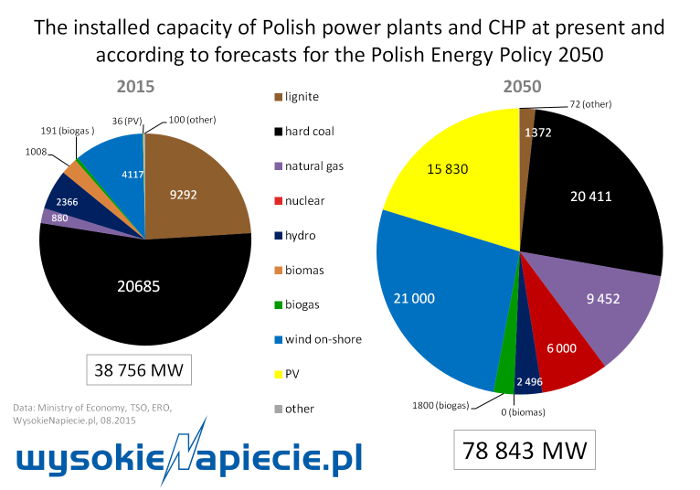

PGE CEO would not explain in detail how the group wants to achieve its target of increasing the diversification of power sources, but indicated that the construction of offshore wind farms would be the fundamental idea. In its strategy, PGE assumed it would reduce the share of lignite to 16% from the current 67%, while that of hard coal – to 5% from 27%. Still, the question remains about the pace of building low-emissions sources. Those mentioned so far by PGE’s representatives, i.e. nuclear power as well as inland and offshore wind farms are not profitable outside the support systems. In the case of the latter, they can remain unprofitable for a long while even under support systems.

PGE’s strategy to date as well as the strategy – if it deserves the name – of the Polish government in the past decade in the field of CO2 emissions reduction assumed an opposite direction than the one indicated by Brussels. While this state of affairs apparently functioned for a while, now such a strategy is becoming more and more risky. Energy generation activities are becoming a burden for companies not only due to the EU policy, but also in connection with the domestic problems connected to coal mining as well as the aging generation assets.

With the realization of the lack of actual influence on the EU regulations, it would be rational to adopt a strategy of following the leader, i.e. the German market. Copying the strategies implemented by such European giants as E.ON, RWE or GDF Suez may actually turn out to be unavoidable.

Opposing climate policy, defending coal industry employees and diversifying natural gas supplies – these are political declarations of Poland's president-elect. Then there are also the declarations of Duda’a party PiS to consider: tilting at windmills, poor support for Poland’s nuclear power plant and for prosumer energy sector. The new president stands for the continuation along the lines of energy policy of PO-PSL government.

Opposing climate policy, defending coal industry employees and diversifying natural gas supplies – these are political declarations of Poland's president-elect. Then there are also the declarations of Duda’a party PiS to consider: tilting at windmills, poor support for Poland’s nuclear power plant and for prosumer energy sector. The new president stands for the continuation along the lines of energy policy of PO-PSL government. I know that changes in Poland will be painful in the short term, but it’s better to prepare the ground for them already. It’s important to learn from other countries’ experiences - says Philip Garner, Director General of Coal Pro, the confederation of UK coal producers in an interview on what went wrong in the UK's coal mining sector and what can happen in Poland.

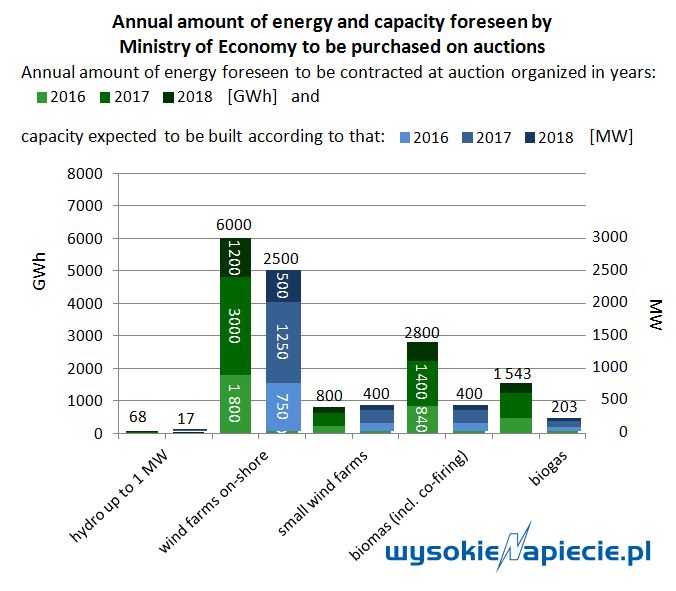

I know that changes in Poland will be painful in the short term, but it’s better to prepare the ground for them already. It’s important to learn from other countries’ experiences - says Philip Garner, Director General of Coal Pro, the confederation of UK coal producers in an interview on what went wrong in the UK's coal mining sector and what can happen in Poland. The Ministry of Economy of the Republic of Poland estimates that renewable energy auctions will take place only in the period between year 2016 and 2018. Investors can expect energy sales at 320-470 PLN per MWh. But the auctions may not be organized for everyone - according to information obtained by the Energy Legislation Observer of the WysokieNapiecie.pl website.

The Ministry of Economy of the Republic of Poland estimates that renewable energy auctions will take place only in the period between year 2016 and 2018. Investors can expect energy sales at 320-470 PLN per MWh. But the auctions may not be organized for everyone - according to information obtained by the Energy Legislation Observer of the WysokieNapiecie.pl website.