Spis treści

In July, 1 MWh (megawatt-hour) of electricity on the spot market (with next-day delivery) cost 342 PLN in Germany and 551 PLN in Poland. Never in history has the price difference been so unfavorable for Poland. It was yet another consecutive month where electricity in current deliveries was the most expensive in Europe in Poland.

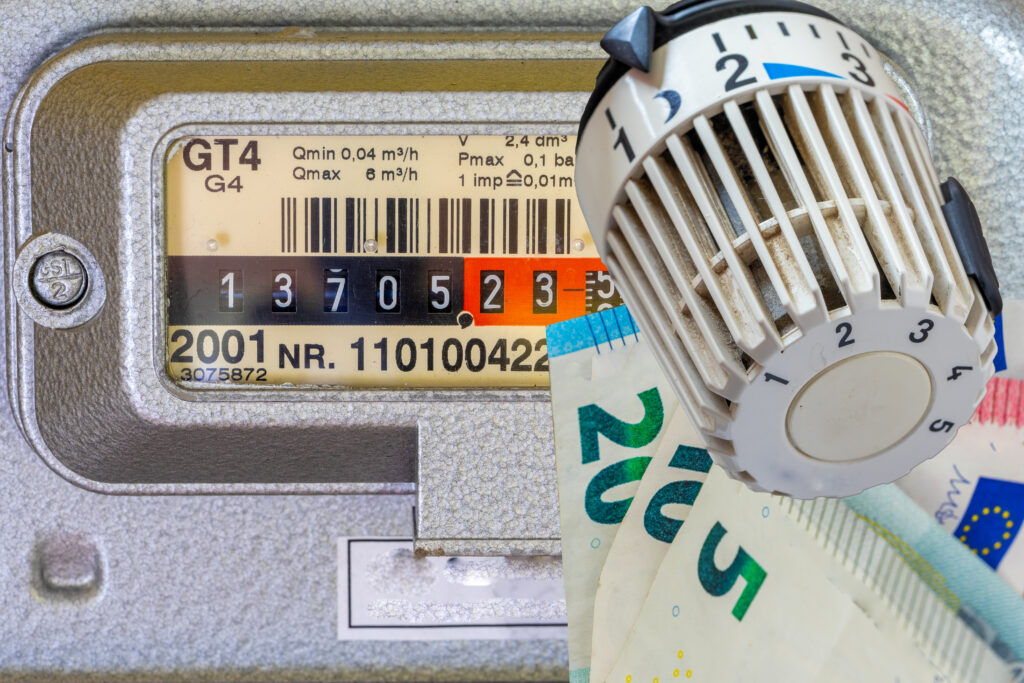

The decreasing cost of gas

There are several reasons for this situation. Firstly, since the peak of the energy crisis a year ago, natural gas worldwide, including in Poland, has become cheaper. In July 2023, on the spot market of the Polish Power Exchange in Warsaw, it cost 150 PLN/MWh, while during the crisis peak in August 2023, blue fuel was priced at 1110 PLN/MWh. Domestic gas prices are practically pegged to valuations on Western European exchanges.

Polish coal is the most expensive in history.

The situation is different for hard coal. Everywhere except Poland, coal prices are decreasing. In July, the price at ARA ports was 450 PLN/ton, and after adjusting this rate to the calorific value of Polish coal (which is lower than in ARA), coal in Europe was already being sold for 396 PLN/ton. At the same time, the index of Polish coal – fuel extracted from Polish mines and supplied to Polish power plants – reached its highest level in history, almost 739 PLN/ton. The cost of generating electricity from Polish coal is now approximately 150 PLN/MWh higher than that from coal imported from Africa or South America, even exceeding 330 PLN/MWh.

As a result, it is cheaper today to produce electricity in Poland from gas imported from North America or hard coal from South America or Africa – transported over 10,000 km – than from Polish coal transported 50 km from mines in Silesia to power plants in Silesia. Consequently, the rest of Europe produces electricity from coal at lower costs than Poland.

CO2 in a sideways trend

Thirdly, CO2 emission permit prices have been moving sideways since the peak one and a half years ago and are currently valued slightly below (around 85 euros/ton) the peaks (100 euros/ton). Countries like ours, where the balance is often closed by high-emission, inefficient coal power plants, have a higher cost. In July, the cost of carbon dioxide in the production cost of electricity in older coal blocks exceeded 360 PLN/MWh.

The market doesn’t see oversupply.

Fourthly, Western Europe is increasingly flooded with cheap electricity from renewable sources. This often leads to an oversupply of electricity in the market and a decline in prices to negative values. In Poland, we also observe this phenomenon (mainly due to 1.2 million homes equipped with photovoltaics), but to a much lesser extent in the stock market. In Poland, there are almost no offers with prices close to zero or negative.

As a result, the transmission system operator takes on the costs of limiting power supply (for example, by reducing import capacities, utilizing emergency energy exports to neighbors, or ultimately, curbing renewable energy generation). Because the power reduction occurs to a significant extent post-market, energy prices on the Polish exchange remain at a higher level than those in neighboring countries.,

Import is increasing.

Despite efforts to limit imports, the export of electricity from Poland has nearly stalled. As a result, our energy trade balance is worsening. Due to lower simultaneity in wind generation, it can be anticipated that in the fall and winter, when wind turbines produce significantly more energy in Europe than in the summer, electricity imports will be much higher than before.

According to estimates from WysokieNapiecie.pl, unless we experience a very cold winter (meaning a sudden spike in gas prices), by the end of the year, we will import as much as 8 TWh more electricity from our neighbors than we will sell to them. This would be the third-worst result in the history of electricity trade.

We export electricity at a higher cost than we import.

Due to current electricity prices, it is very possible that we will close this year with a trade balance in foreign electricity trade comparable to or worse than the worst year so far, 2019 (when Poland had a net outflow of almost 527 million euros for purchasing electricity).

This may happen despite the fact that the average prices at which we export electricity are higher than import prices. The key factor will be the significant difference in volume, with the volume of imports far exceeding that of exports. Depending on the severity of the winter, the final deficit in Poland’s electricity trade for the year 2023 could range from 2 to over 3 billion PLN.

Electricity prices for 2024

The situation is somewhat different in contracts for electricity in the year 2024. Similar to the spot market, we observe declines, but they are smaller. This is a result of the ongoing uncertainty regarding Europe’s ability to fully cover its demand for natural gas. The import capacities for this fuel from outside Russia are lower than the gas consumption before the crisis. If the winter turns out to be harsh and less windy, we could witness renewed dynamic increases in natural gas prices, and consequently, increases in electricity prices as well.

As a result of these concerns, electricity prices in contracts for the year 2024 in Germany remain above 730 PLN/MWh, while in Poland, electricity for the year 2024 is priced at 656 PLN/MWh (77 PLN cheaper than in Germany). However, trading in this product has almost come to a standstill after the elimination of the exchange obligation. In July, turnover for base contracts for the year 2024 amounted to only 3 TWh, compared to 6 TWh the previous year and 11 TWh two years ago.

Electricity prices for large companies are falling, but…

The falling wholesale prices of electricity are already reflected in contracts offered to companies not covered by government support. However, there is one condition – customers must bear almost all the risk, as there is a lack of energy companies willing to offer a fixed price for electricity in 2024.

− At the moment, fixed-price offers are already a product for households and small businesses consuming up to 1 GWh of electricity per year. Offers for larger consumers are mainly based on prices indexed to the exchange or the possibility of purchasing in tranches, at times specified by customers. Sellers add the costs of the consumer profile, peak certificates, guarantees of origin (if required by the customer), excise tax, financing costs, and their margin to these prices − says Mateusz Brandt from Brandt Energy Consulting in an interview with WysokieNapiecie.pl.

− This allows for buying electricity more cheaply today. Just a year ago, at the peak of the crisis, fixed-price offers for this year amounted to 3500 PLN/MWh (3.50 PLN/kWh). At that time, we conducted a tender for our client for spot market purchases, where sellers competed with the lowest additional costs of servicing the contract (excise tax, color certificates, profile cost, etc.). The cheapest offer was 70 PLN/MWh, and the most expensive was a whopping 700 PLN/MWh. Current prices for the fourth quarter are a little over 500 PLN/MWh, so with additional costs, the customer can fit below 600 PLN/MWh if they decide to purchase such a tranche today. This is over 80% cheaper than the fixed-price offer from a year ago. However, it should be noted that the market is currently in a downward trend, so these savings are easy, but the situation may reverse, and the risk of price changes will remain with the consumer − adds Brandt.

− In the near future, we primarily have two risks that will impact energy pricing. The first is winter – whether it will be mild or severe – and the second is the change in systemic regulations, along with the disappearance of price restrictions on the Balancing Market, which currently apply to coal and gas power producers − notes our interviewee.

Small companies pay huge margins

Traditionally, the highest electricity rates are offered to the smallest companies because they lack the scale of large enterprises and do not have the state protection that private consumers enjoy. If they fall into the category of micro, small, and medium-sized enterprises, they can expect subsidized electricity rates until the end of the year, down to the level of 785 PLN/MWh plus excise tax (5 PLN/MWh), VAT, and distribution fees. However, if they sign a fixed-price contract today for, let’s say, two years, and state subsidies run out, they will end up paying a hefty price for electricity.

− The current situation is the least favorable for the smallest business consumers. Margins for sellers in this segment can reach up to 200 PLN/MWh today, while previously, margins above 50 PLN/MWh were unthinkable in this segment. Small business consumers should definitely scrutinize their bills and look for competitive offers − urges Mateusz Brandt.

Electricity tariffs for 2024

The theoretically falling electricity prices should also be reflected in tariffs for household consumers. Theoretically, because remember that the President of the Energy Regulatory Office approved electricity tariffs for 2023 for household consumers at a level of over 1 PLN/kWh net (excluding distribution fees). However, in settlements with household consumers, the first 2000-3000 kWh per year are billed at a rate subsidized by our taxes at almost 60%. This is because we use prices from 2022, at a rate of 41 gr/kWh net.

Meanwhile, from January to the end of August, the average price of a base contract for 2024, which serves as the basis for calculating official electricity tariffs, was 725 PLN/MWh, or 72.5 gr/kWh. If we have a windy and warm winter, it is possible that the final average annual price of these contracts will drop to the level of 60-65 gr/kWh. It will still be about half more than the current “frozen” tariffs up to the limit. However, everything indicates that prices will already be lower compared to the rate applied above the annual consumption limit. This rate is currently 69.3 gr/kWh (still without excise tax, VAT, and distribution fees).