Spis treści

The majority of proposed protective mechanisms are set to be implemented in the first half of 2024. Coalition politicians anticipate that fuel and energy prices in the markets may continue to decline, and perhaps in the second half of the year, support may no longer be necessary.

Freezing electricity prices in 2024

The law extends the maximum energy prices for households until mid-year up to the consumption limit (reduced by 50%, as it is intended to be in effect for only six months). This is set at 412 PLN/MWh net (plus 5 PLN/MWh excise tax). Also, above the limit, the rate is to be maintained at 693 PLN/MWh (plus 5 PLN/MWh excise tax). Local governments and public utility entities are also required to pay this second rate as the maximum price.

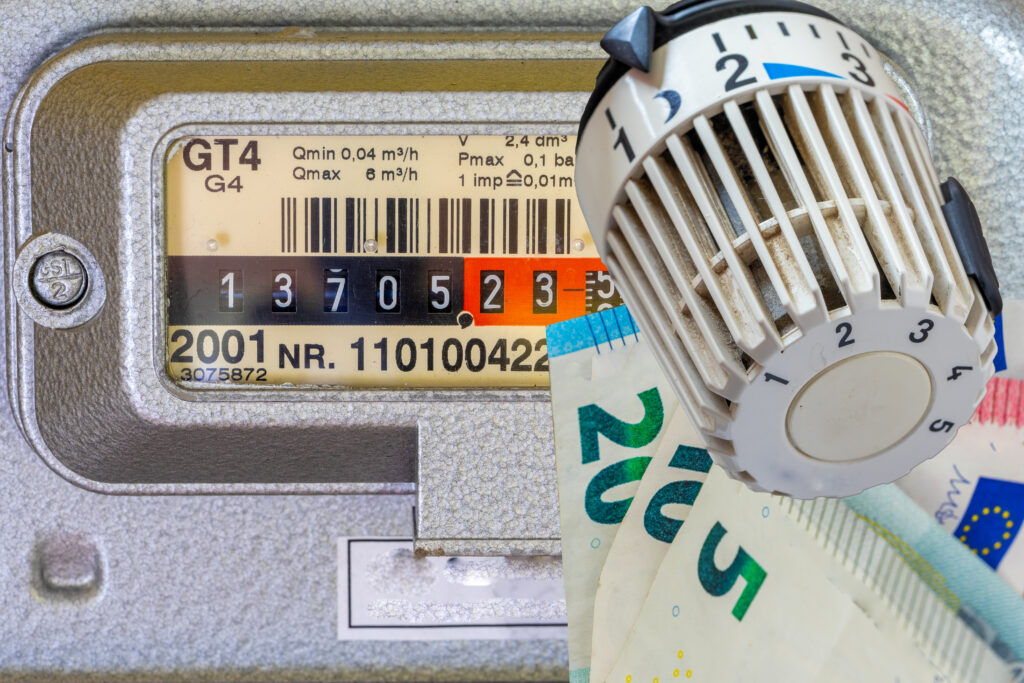

Freezing gas prices in 2024

The law extends the freeze on the sale prices of gas (200 PLN/MWh for households) and its distribution until mid-2024. This is the maximum price, and sellers may offer lower rates to customers (current market prices for gas for the coming months, quarters, and years fluctuate around 200-220 PLN/MWh).

Additional protection has also been maintained in the form of the possibility of VAT reimbursement for gas expenses for individuals heating their households with this fuel, with income criteria remaining the basis for eligibility for such reimbursement.

Freezing heat prices in 2024

The law, with some changes, also extends the system introducing maximum prices for network heat sales – as it is currently – to households, communities, cooperatives, or public utility entities.

Higher protective supplements

The law increases protective supplements by the inflation rate for the year 2022. From January to June 2024, they will be higher by 14.4%.

Obligation on the stock exchange: 100% with exceptions

Members of parliament aim to reinstate the mandatory sale of produced electricity on the stock exchange in the form in which it was introduced when Krzysztof Tchórzewski was the Minister of Energy. The stock exchange obligation theoretically stands at 100%, but energy produced from renewable or cogeneration sources is exempt from this requirement.

The stock exchange obligation is set to take effect from July 1, 2024. At the request of energy producers who have long-term contracts securing loan agreements or contracts with the Power System Operator (PSE), the President of the Energy Regulatory Office (URE) may exempt them from the obligation for that portion of production.

The law terminates long-term electricity sales contracts that would hinder compliance with the obligation. In the case of contracts within energy groups, such agreements are set to expire on December 31, 2024, and for contracts with companies outside the capital group, three years from the effective date of the law.

Orlen will pay almost PLN 15 billion

The entire operation will be financed at the expense of Orlen. So far, the fuel champion has been burdened with a gas fee since the end of 2022, the costs of which, while shrouded in secrecy, are known to be significantly lower than imported gas. However, this fee has been in effect since the end of 2022. The coalition wants to additionally charge the company for the period from October 2021 to the end of 2022. Orlen extracts about 4 billion m3 domestically, and total consumption in Poland reaches approximately 17 billion m3. According to information from the WysokieNapiecie.pl portal, coalition members have calculated that Orlen will pay PLN 14.6 billion for the entire year.

It is worth noting that oil and coal companies should be subject to a special EU windfall profits tax introduced by EU regulation. It amounts to 33% of income exceeding 20% of the average income from 2018-2022. However, the government has chosen not to impose it on Orlen – instead, it decided to introduce a surcharge on profits from domestic extraction. The coalition also wants to take advantage of this source, deepened by the year 2022.

Originally, the coalition’s project proposed freezing gas prices for the entire year and indexing frozen electricity prices by the inflation rate for the previous year, i.e., by 14.4%. However, apparently, the prospective Prime Minister, Donald Tusk, decided that the coalition could not be “worse” than the current government, which in its project maintained frozen prices at the current level, without the inflation index. Ultimately, gas prices were frozen for six months, just like electricity prices.

Wind turbine distance will depend on its noise level

The project introduces significant changes to the law on investments in wind power plants, completely altering the current regulations. Firstly, the determination of the distance between wind turbines is linked to the distance of areas requiring noise protection based on the maximum emitted noise. The minimum threshold is 300 m for areas of multi-family residential buildings, collective living, farmsteads, recreational and service-residential areas. The distance gradually increases from the threshold of 104 dB (A), reaching 606 m at 110 dB (A). Then the minimum distance is 2 km. For example, one manufacturer states that its 4.2 MW turbine emits 104.9 dB (A), meaning that according to the proposed regulations, it would have to be placed at a distance of at least 352 m.

For areas related to single-family housing, children or youth residence, social care homes, hospitals, and resorts, the minimum distance of a wind power plant starts from 400 m, and at 110 dB (A), it is 994 m. For these areas, the described turbine could be built at a distance of at least 607 m. The distance is measured from the shortest section between the power plant and the building or the boundary of the noise-protected area.

The project also states that the minimum distance from a national park and nature reserve is 300 m.

Fast track for wind turbines and a tax for municipalities

The project proposes that renewable energy investments with a capacity exceeding 1 MW, especially wind power plants, be considered public purpose investments. Wind power plants are also to be strategic investments, in accordance with the law on providing information on the environment and its protection.

The location of wind power plants can be determined through a local spatial development plan, an integrated investment plan, or a resolution of the municipal council. The latter solution is a novelty proposed in the project. The resolution would be adopted at the investor’s request, independently of the conditions and spatial development study and local spatial development plans, provided there is no ban on the construction of wind power plants, and the area is not designated for residential or mixed-use buildings. After entering into force, the resolution would invalidate the local spatial development plan in part related to the power plant. The project even states that in this case, obtaining consent to change agricultural land to non-agricultural purposes is not required.

Municipalities would receive a tax of PLN 30 per kW of power from wind power plants. The investor would pay this tax annually to the municipality. The municipality could spend this money on reducing energy poverty, developing infrastructure around the wind power plant, and mandatory at least 20% on the civic budget. The investor exempt from this tax would be one who sells at least 10% of the electricity produced to the residents of the municipality and they effectively hold shares in the installed power of the power plant. At the same time, the provision regarding offering this volume of energy to residents has been changed – it is not to be an obligation but only a possibility.

Other changes in the project concern the removal of provisions regarding the distance of wind power plants from the highest voltage networks and the removal of provisions regarding the certification and registry of wind turbine service technicians.

The project also introduces the possibility of modernizing existing wind power plants, with RDOŚ approval required if the capacity exceeds 50%.

In the spatial planning and development law, it is proposed to abolish restrictions on the obligation to use local spatial development plans for OZE construction on class IV agricultural land and for OZE with a capacity of over 1 MW. The obligation for municipalities to adopt general plans has been postponed by two years, which means that conditions and spatial development studies will remain valid until the end of 2027.