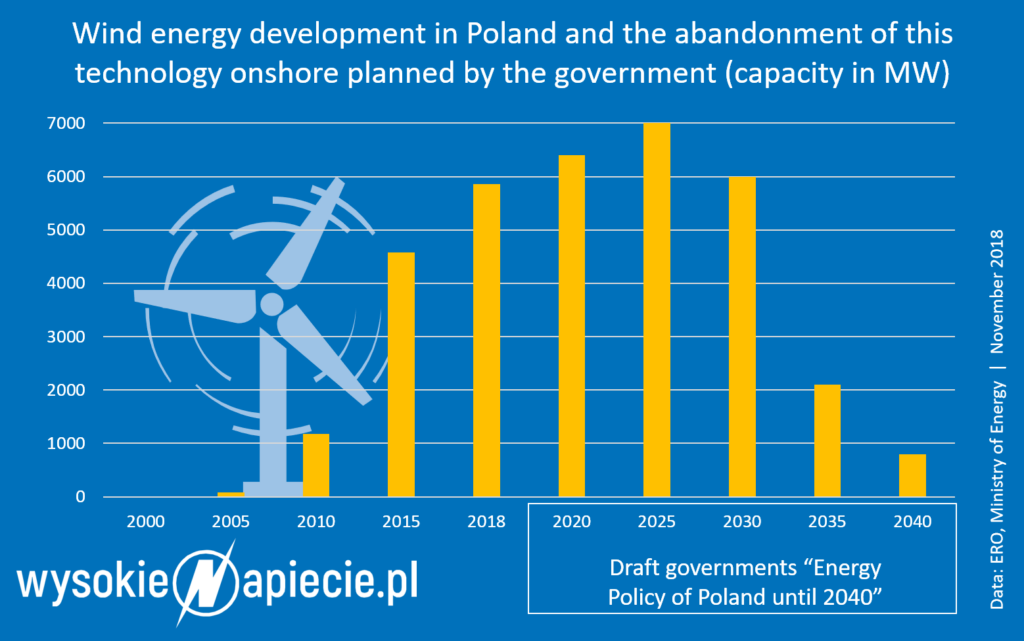

Large RES Auctions in 2019 to be continued in the coming years

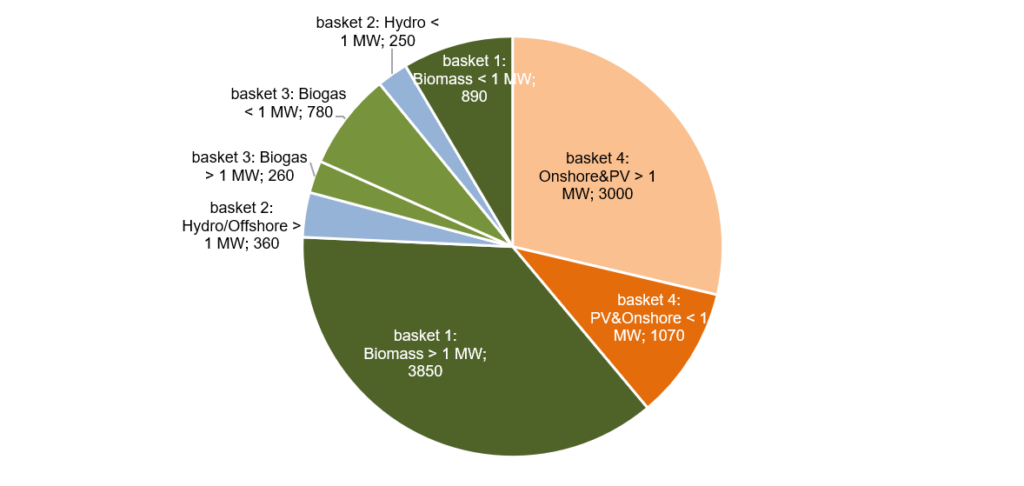

The 2019 volume to be auctioned for new RES generators has been subject to a remarkable change. The volume previously announced by an (invalid due to delayed publishing) execution regulation in December last year has been re-designed in favour for onshore wind farms and substantially differentiates from 2018 auction volume as shown below. The auction volume for 2019 which in December 2018 was scaled at 12.5 TWh/year has been recently decreased to 8.2 TWh/year – simply due to the fact that even taking into account 2.7 GW of onshore wind farm projects there is no sufficient amount of fully permitted RES projects on the market to provide to more than 8 TWh yearly production by new generation.

The auction volume for 2019 which in December 2018 was scaled at 12.5 TWh/year has been recently decreased to 8.2 TWh/year – simply due to the fact that even taking into account 2.7 GW of onshore wind farm projects there is no sufficient amount of fully permitted RES projects on the market to provide to more than 8 TWh yearly production by new generation.

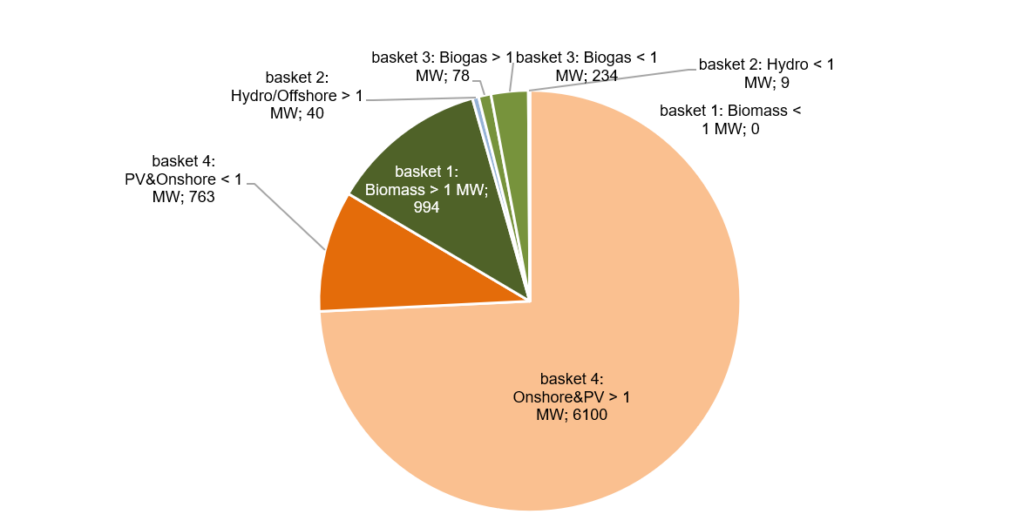

2019 auctioned volume in GWh per year (15-year support period) Total auctioned volume 8.2 TWh/yearFurthermore, the auction support system shall be prolonged from 31 December 2035 until 30 June 2039. Therefore, the last possible date for entry into the support system to achieve 15-year support is 30 June 2024. Consequently, at least in 2020 and 2021 RES auctions should be continued. However, from 2020 only a handful of fully permitted onshore wind farm projects will qualify for RES auction (developed in accordance with the still obliging 10H distance rule), so large solar farms become competitive.

Important change of Contract for Difference support improves bankability

Currently, a CfD is granted for 15 years to be settled in case of a „negative balance“ (indexed bid price exceeds the base wholesale price for the respective month) with ZRSA settlement agency on monthly basis. However, in case of a „positive balance” (base wholesale price exceeds the indexed bid price for the respective month) no premium is granted, but a repayment claim is accruing and settled against future negative balance to be finally settled and eventually paid (back) after 15 years (price risk). This regulation has been critized by both, investors and ZRSA. Although ZRSA opted for shortening the settlement period to a full three-year period to correspond with the volume risk penalized in case the energy production falls below a 85% threshold of the energy volume awarded at auction, the Ministry of Energy did not agree to such change. Even more, the pay-back claim in case the “positive” balance exceeds the “negative” balance during the 15-year support period will be limited only to the paid “negative” balance. So, in case onshore wind farms start settlement in the early twenties with a “positive” balance due to low bid prices the bid price becomes a “true floor” which substantially improves the bankability of the CfD support system.

Biomass generators granted 42 months to enter into support system

Biomass and biogas generators have more time to enter into support system. Currently, both types of generators have only 36 months to enter into support system after respective auction has been closed – conditional upon obtaining a generation license. In case of large biomass installations this timeline is very tight, so the Ministry of Energy changed the timeline to 42 months. However, also the PV sector critized the tight timeline of 18 months to obtain generation license and to enter into support system. Currently, only license proceedings with the regulatory office ERO may take up to 6 months. Nevertheless, for the time being the Ministry of Energy seems not to be willing to extent the timeline also for PV installations which may provide to difficulties in obtaining construction finance.

Yearly volume, entry date into support system and also installed capacity may be actualized

The yearly bid volume submitted at auction and the date of planned entry into support system may be subject to actualization prior to entry into support system. The 15-year generation volume submitted at auction is not subject to a possible change. The adjusting mechanism improves the bankability of RES projects, especially for projects with higher LCOE values like biogas and biomass, as the CfD payment substantially affects their cashflow from the start of operation. At auction date it is almost impossible to forecast the date of entry into support system, so bidders are forced to submit the last possible date as entry date, and are currently not motivated to speed up construction and commissioning. Even more, the RES Act amendment also states that the installed electrical capacity may be actualized prior to entry into support system – as long as such change in installed capacity would not provide to a change in the applicable basket, i.e. up to or more than 1 MW installed electrical capacity. In praxis investors already obtained individually appropriate interpretations by ERO, however, the legal situation wasn’t yet entirely clear. Finally, presenting an environmental decision at prequalification for auction is not anymore required.

Grid connection date to be agreed with the system operator

Furthermore, the draft act introduces an obligation for the grid operator to prolong grid connection agreement respective RES generator which has been awarded at auction latest within the timeline provided by the RES Act, i.e. 18 months with PV, 30 months with onshore wind and 42 months with biomass and biogas RES generators. However, this does not provide an obligation for grid operators to shorten grid connection timeline, which is of importance mainly for PV. The RES Act requires awarded bidders to enter into the support system within the respective timeline, i.e. to connect the generator to the grid, to obtain permit of use, subsequently to obtain generation license and finally to submit for entering into the support system – and not to just connect respective operator to the grid. Such process may easily take 4-6 months after grid connection, so the timeline to connect respective RES generator to the grid should be adopted to allow PV installations to enter into support system. Currently, DSOs often provide timelines to connect respective PV installations to the grid which does not match the required timeline after subject PC project has been awarded at auction.

Existing grid connection agreements prolonged until January 2020

According to the draft act grid connection agreements concluded prior to RES Act entering into force, i.e. before 4 May 2015 shall be subject to prolongation so that the grid connection date shall occur January 2020. Due to the fact, that the next auctions will take place after 4 May 2019, the originally planned date to allow grid operators for termination of “old” grid connection agreements will not be applicable. However, in case respective RES generator equipped with an “old” grid connection agreement will not win 2019 auction it is still unclear whether existing grid connection agreements will be subject to possible termination after January 2020. Further amendments to the Energy law Act may be expected after 2019 auction.

New cap for substitution fee proposed

A new price formula for capping the substitution fee for existing RES generators supported by the Green Certificate system shall be implemented – this system has been closed for new entries on 30 June 2016. The substitution fee shall be capped by the difference between a value of approx. PLN 312 and the average wholesale prices for the previous year announced by ERO (e.g., amounting to PLN 194.70 in 2018). Currently, the joint revenue for both, green certificates and day-ahead wholesale prices at POLPX amounts to PLN 350 – 380/MWh. Such change may be subject to notification decision by EU Commission, consequently an entry into force is planned for 1 January 2020. In parallel, the quotation for 2020 shall increase to 20%. However, due to substantial oversupply of Green Certificates and the market power of Polish state-owned utilities to influence the small Green Certificate market a founded mid-term price prognosis is not possible.

Changes concerning small RES generators and micro-generators

The FiT and FiP support system which is eligible for hydroenergy and agricultural biogas plants up to 499 kW (small generators) and 1 MW installed electrical capacity, respectively, shall obtain also biomass installations. Furthermore, reference prices which are published each year for auctions taking places in the subsequent year shall be gross prices, so they should be reduced by the respective amount of VAT. Reference prices for 2019 have been already published in 2018, so this regulation may apply from 2020 onwards. Finally, the installed capacity for micro-generators has been extended to 50 kW. This might be of importance in the near future, as the Ministry of Entrepreneurship and Technology published a draft act promoting a programme called “Energia Plus”, which promotes self-generation by extension of the current net-metering regulation to all micro-generators (currently, this pricing mechanism is capped at 10 kW capacity) and possibly even to small generators – which has been critized by ERO as possible destabilization of medium voltage grids.