The report at hand provides investors, banks and project planners with crucial information about the new Polish auction scheme for renewable energy sources (RES).

ADVERTISEMENT

The RES auction scheme sets a new regulatory and economic framework for investments in renewable projects in Poland from 2016 on. This report aims to point out the consequences for market participants when taking part in RES auctions from 2016 on; it has three main parts:

- Overview of RES auction regulations – input provided by law firm Solivan (http://www.solivan.pl/en)

- Wind yield estimation and associated risks in the auction – input provided by wind experts anemos GmbH (www.anemos.de/en)

- Price forecast, profile costs, risk estimations and sample calculations for wind farms – input provided by power market consultants enervis energy advisors GmbH (www.enervis.de/en)

The first part of the report gives an introduction to the new RES auction scheme in Poland. It points out the timeline for the implementation of the law and gives an overview of the implications on renewable energy projects, especially wind farms and photovoltaics. The different auctions for installations of up to and above 1 MW installed capacity as well as the general auction system with Feed-in-Tariffs (FiT) for small and Feed-in-Premiums (FiP) by contracts for difference (CfD) for large RES generators are explained in detail. Special attention is given to the prequalification requirements for any RES project to take part in the future auctions. In addition, the first part of the report provides an update on the latest reference prices published by the Polish government, detailed information on the auction process and the total cap on RES expenditures and expected changes in other legislation such as planning and building law that will have a strong influence on renewable energy projects.

The second part of this report addresses wind yield estimation and associated risks in the auction (offered generation volume). It gives and introduction to the modelling of wind speed and the subsequent calculation of the energy yield. The impact of uncertainties in the calculation and the methodology of long-term wind speed forecasts are described. A further focus is the calculation of the probability of exceeding the -15% criterion, which is part of the penalty regulation in the new Polish RES legislation.

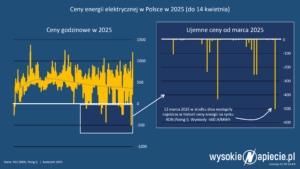

The third part of the report gives a short introduction to the Polish power market. It analyses the existing generation portfolio and historic prices on the day ahead market as well as on the market for balancing energy. In addition, the assumptions on future development of the sector for the power price forecast are presented. After that the methodology for calculation of profile costs of renewable energy sources is explained in detail and the historic profile cost of wind energy is calculated. For this purpose historic power prices and wind energy feed-in as well as wind-speed and energy yield for different exemplary wind farm sites in Poland are analyzed. The results are presented in form of pictures of historic market value atlas and the development of the market value of wind energy. To give a statement about the future development of profile costs of RES in Poland the results of the power price forecast are combined with long-term wind data to create pictures of the future market value atlas for different wind turbine technologies and sites.

The results of the forecast of market values for wind and solar PV energy are given for exemplary locations and technologies up to the year 2040. As a summary the impact of the future development of market values as well as the -15% criterion on the bidding process in the RES auctions is pointed out.

The report addresses the following new challenges that RES investors will face while preparing for the auctions and while operating the project afterwards:

- market value and technology-specific profile costs of RES

- risk of over-performing the offered volume (no CfD payment),

- risk of under-performing the offered volume below the penalty threshold,

- risk of marketing energy after the CfD support period (beyond 15 years),

- balancing costs,

- risk of negative prices at wholesale market providing to loss the premium.

This market report shall enable investors and financing banks to understand the methodology that is necessary to evaluate RES projects in detail and to find a general basis for financial modelling (and indicative term sheets) half year before the first auction is expected to take place. However, this report cannot replace a more specific project assessment in terms of legal, economical and technical (wind yield) analyses that need to be carried out on the eve of the auction to finally determine the optimal bid price and volume for the given project.

The report is available only in English.

Do you want to buy ?

Download the order form and send it back to us at [email protected]

Have you got any questions?

Ministerstwo Energii chce wyodrębnić rynek zielonych certyfikatów dla biogazowni rolniczych. Odpowiednie przepisy znajdą się w projekcie nowelizacji ustawy o OZE. Zmiana ma pomóc finansowo właścicielom tych instalacji, ale może mieć skutki uboczne.

Ministerstwo Energii chce wyodrębnić rynek zielonych certyfikatów dla biogazowni rolniczych. Odpowiednie przepisy znajdą się w projekcie nowelizacji ustawy o OZE. Zmiana ma pomóc finansowo właścicielom tych instalacji, ale może mieć skutki uboczne. Polska polityka energetyczna powinna uwzględniać nadchodzącą trzecią rewolucję przemysłową. Podejście „inwestujemy w każdą technologię po trochu” zdradza brak zrozumienia w którym momencie transformacji się znajdziemy – pisze dr Christian Schnell.

Polska polityka energetyczna powinna uwzględniać nadchodzącą trzecią rewolucję przemysłową. Podejście „inwestujemy w każdą technologię po trochu” zdradza brak zrozumienia w którym momencie transformacji się znajdziemy – pisze dr Christian Schnell. Ten rok odrobinę wyjaśni sytuację w górnictwie. Pod koniec stycznia ma być gotowy plan finansowy dla Kompanii Węglowej. Kopalnie będą ciąć koszty i ścigać się ze spadającymi cenami węgla. Ale czy mogą wygrać ten wyścig?

Ten rok odrobinę wyjaśni sytuację w górnictwie. Pod koniec stycznia ma być gotowy plan finansowy dla Kompanii Węglowej. Kopalnie będą ciąć koszty i ścigać się ze spadającymi cenami węgla. Ale czy mogą wygrać ten wyścig?