“There is a debate in Europe about the electricity market design. It is the most important dispute concerning the electricity industry”, emphasizes Eryk Kłossowski, the President of the Management Board of Polskie Sieci Elektroenergetyczne. “The main dividing line between parties arguing over the Europe’s electricity market project remains geographical extent of the bidding zones, or areas, within which prices of electricity, reserves and ancillary services are determined.”

“The European Electricity Market – diagnosis” is the first of the series of PSE’s publications concerning the European electricity market. It aims at initiating a comprehensive discussion on the energy market – its current design inefficiencies and future architecture.

The current challenges, related to the growing number of prosumers, the increasing role of RES and decentralized generation, as well as the change of the demand patterns caused, i.a. by the development of electromobility, require the operators to rethink the foundations of the European energy market, including market design. Unfortunately, currently pursued regulations often respond to yesterday’s, not the current or future challenges. Therefore, the diagnosis prepared by PSE points out the key areas that require changes in the market model:

the division into large bidding zones (areas)

Today the actual delimitation of zones was made taking into account mainly the existing administrative boundaries coinciding with state boundaries, with a few exceptions, and not an analysis of transmission capacity within them. Due to political rather than technological reasons, zones are difficult to change in order to optimize their configuration. Moreover, the network representation in the zonal model is highly simplified, causing detachment of market and system operations (depending on the physics). In the opinion of PSE, European market outcome within large bidding zones is often physically infeasible, requiring TSOs to take a large number of out-of-wholesale-market remedial actions aimed to ensure the secure operation of the system. The scale of these actions may lead to a serious reduction of the operational security margin of the transmission system.

the preferences for the energy-only market

The trade can take place under energy-only market formula, where energy and capacity are traded in a single market process (like today in most European countries) or an energy-plus-capacity market, where the market processes for energy and capacity are separated. There are justified concerns that future price signals on an energy-only market will not create the conditions for functioning or deployment of all stable generation sources necessary to ensure the operational security of the power system, which may result in generation outages in the future. Moreover, in reality, the energy-only market does not provide correct signals for investing in the network development, which may lead, in some cases, to oversizing investments. Consequently, in the opinion of PSE, energy-only market is not suited to the technological and business challenges faced today by the sector.

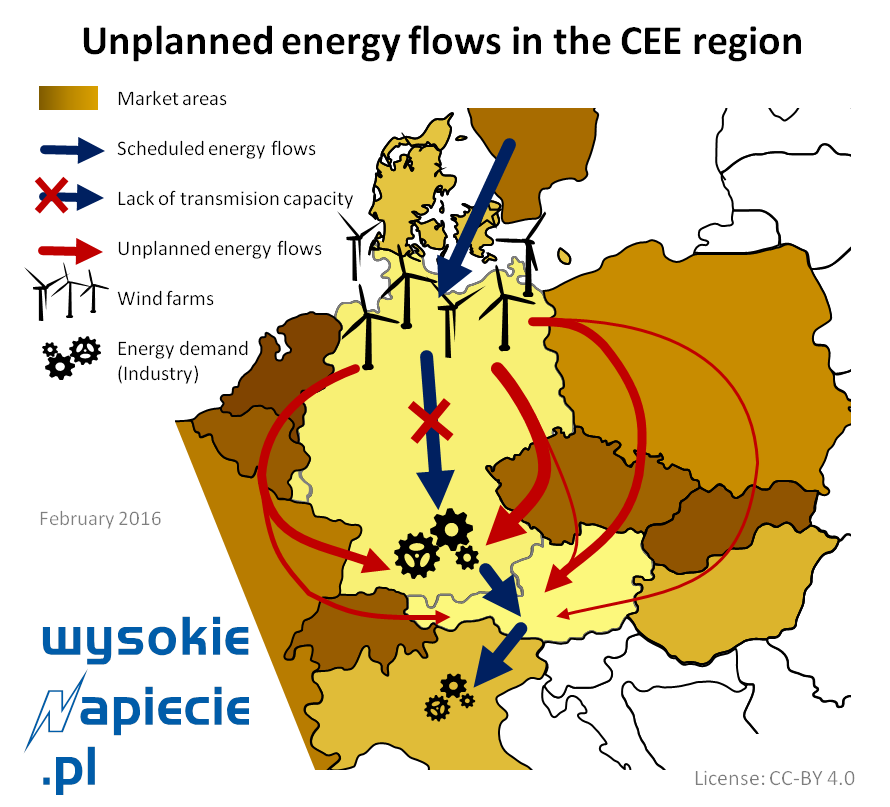

the preference for cross-zonal exchange

It is intended as another tool to enhance supra-national market integration. Unfortunately, nowadays it contributes to growing problems in the system management, which arise from the contradiction between the fundamental feature of the zonal model, i.e. the “copper plate” assumption, of unlimited transmission capacities and trading possibilities within each bidding zone, and the preference for cross-zonal transactions, which are technically limited by cross-border capacities. In reality, underutilization of cross-border infrastructure is mainly due to zonal market imperfections, particularly loopflows i.e. “power flows leaving and re-entering the given bidding zone without being scheduled”. Increasing loopflows impact the secure operation of the interconnected system and may prevent the accomplishment of the goals of the EU’s energy policy. This problem cannot be solved by any regulations that artificially increase the cross-zonal capacities and in effect will create only artificial exchanges.

Given the new challenges, the perseverance of policy makers to rigidly maintain the solutions that in the past allowed building the European energy market is unjustified. “European electricity industry cannot be closed for new ideas, and should rather look for enriching experiences and drawing inspirations”, stress the authors of the diagnosis. According to their opinion, a remedy for the European challenges are the smallest possible bidding zones and resulting from it “locational signals that would allow for much better grid utilization without going beyond the secure boundaries of system operation. Improved, more locational market design should better contribute to reaching all objectives of the European energy policy contributing to higher social welfare for all Europeans.”

In the forthcoming publications, PSE will present the outline of the future market design, responding to the new challenges pointed out in the Diagnosis and founded on four fundamental pillars: economic efficiency, system security, incentive compatibility and market transparency.

Download full article: PSE Diagnosis_short_FINAL_EN

The full text of the diagnosis is available at www.pse.pl

Prof. Pantelis Capros for WysokieNapiecie.pl: According to our forecasts, most existing hard coal- and lignite-fuelled power plants will continue to rank ahead of CCGT facilities until close to 2030 in terms of variable operating costs, even considering the ETS prices. However, the time horizon until 2030 is too short for the business viability of a new lignite/coal investment.

Prof. Pantelis Capros for WysokieNapiecie.pl: According to our forecasts, most existing hard coal- and lignite-fuelled power plants will continue to rank ahead of CCGT facilities until close to 2030 in terms of variable operating costs, even considering the ETS prices. However, the time horizon until 2030 is too short for the business viability of a new lignite/coal investment.

The situation on the Polish-German border poses a threat of an uncontrolled outage of the grid in the EU, in a scale comparable to the infamous collapse of the western European power system in November 2006, Polish power grid operator warns in a report. The Polish government is asking the EU energy commissioner for help.

The situation on the Polish-German border poses a threat of an uncontrolled outage of the grid in the EU, in a scale comparable to the infamous collapse of the western European power system in November 2006, Polish power grid operator warns in a report. The Polish government is asking the EU energy commissioner for help.