Spis treści

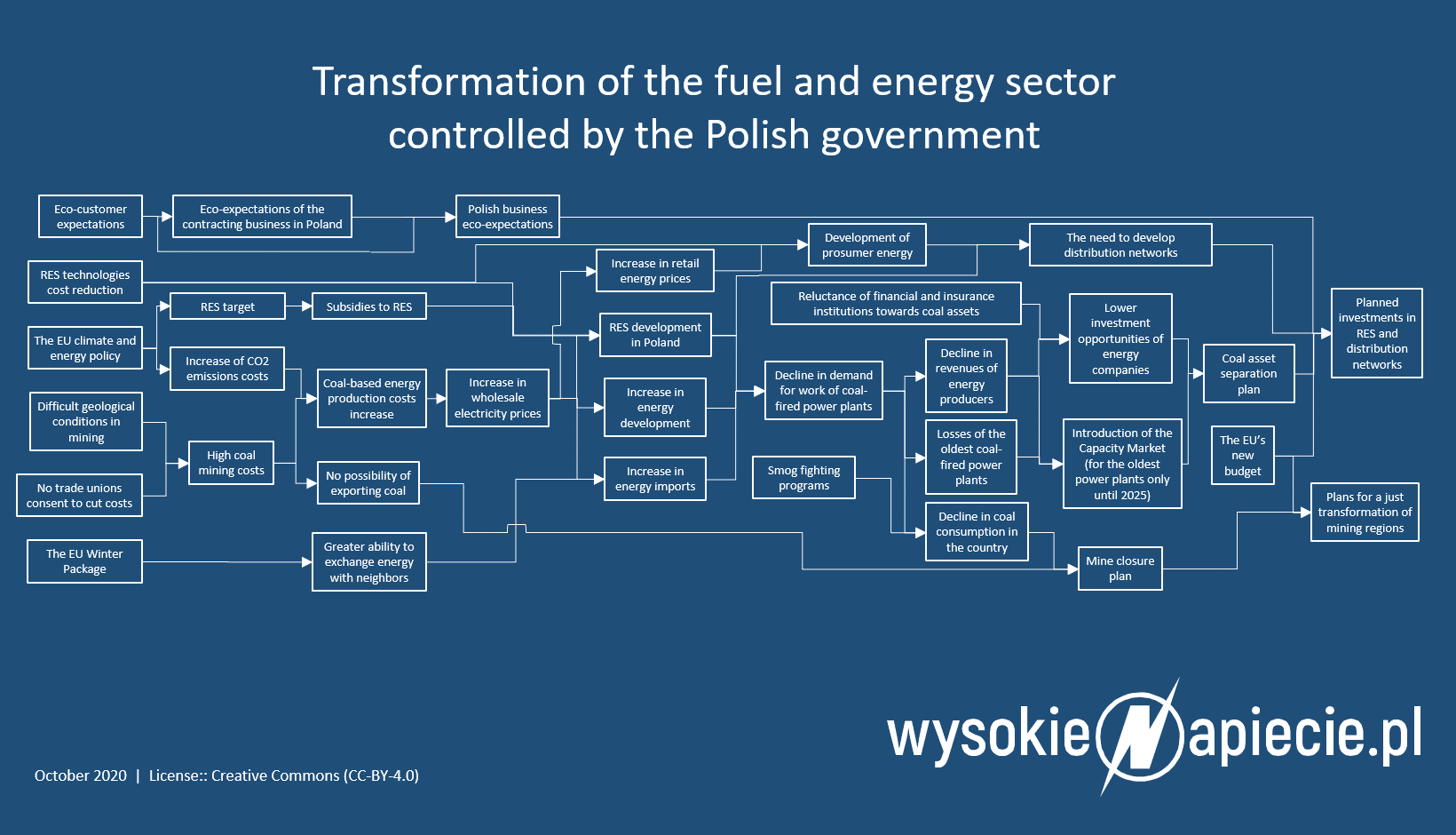

For the past 5 years Polska Grupa Energetyczna has spent approximately 20billion PLN for coal related investments. Almost 10 billion was spent only on two power units in Opole, and a power unit still under construction in Turów will cost ca. 6 billion. This capital is practically lost for the group, it will not generate any return on investment. The strategy announced by Polska Grupa Energetyczna on the 19th of October bears sad testimony to a lack of imagination of subsequent policy makers. Since 2012, regardless of who was in power at that time, not only in Poland, it was clear hat the EU power policy meant the decline of coal position, but it was not recognized in Poland.

At the press conference, the current President of PGE, Wojciech Dąbrowski, did not hide difficult situation the company found itself in. PGE needs money for new investments and its strong connection with coal makes financial institutions unwilling to discuss any new credits. “Scarcely anyone would insure coal assets, and if so, that will be under high cost”, says Dąbrowski at the press conference. Meanwhile, PGE needs new credits for the planned investments, mainly for sea wind power plants.

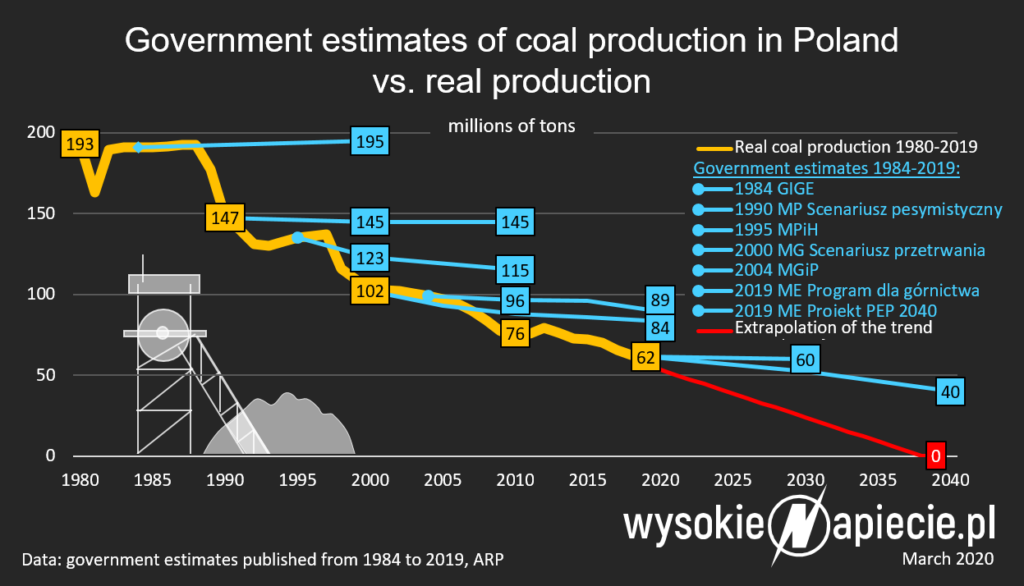

See also: Coal production in Poland closer to the end than claimed by politicians

The black to wreck, the green to win

What does PGE strategy include? We should start on the fact it consists of 40 slides, but its “content layer” is far from elaborated – “briefed” stock exchange news release fits into single page. Undoubtedly, to quote Goethe, conciseness makes perfect, but in this case it has obviously gone too far. It is not so much of a burden to the company, as it is to the owner, i.e. the State Treasury, still remaining silent in the key issue – separation of coal assets.

The President Dąbrowski said he would like the new entity of the State Treasury (under a working name of: Narodowa Agencja Bezpieczeństwa Energetycznego, National Agency of Energy Security) until the end of the next year to take over all lignite and coal operating PGE power plants. It means PGE would like power plants grouped in TPGE Górnictwo i Energetyka Konwencjonalna (commonly known as „Gieksa”) to be directed to NABE. Such power plants are located in Bełchatów, Turów, Opole, Rybnik and Dolna Odra.

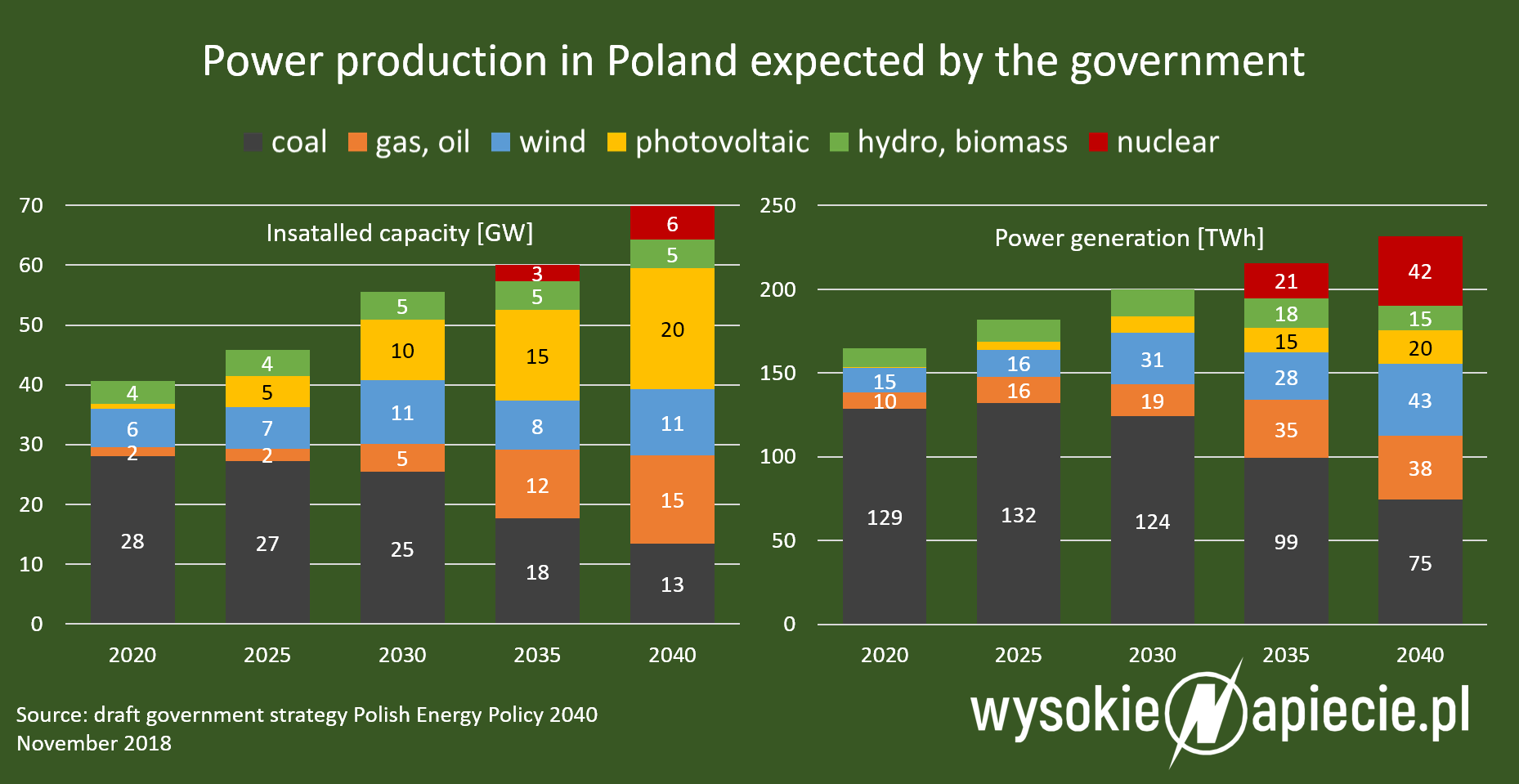

PGE wants to develop renewable energy resources and distribution and to invest in CHP plants and new technologies. In 2030, the power of its wind farms on the Baltic sea is to reach 2.55 GW, and as a result of preparation of new projects in new areas, by 2040 it should exceed 6.5 GW. Moreover, within next 10 years,the company intends to construct photovoltaic farms of total power of 3 GW and new wind farms on land of total power 1 GW. The construction of the first in Poland huge gas power plant in Dolna Odra (1400 MW) is to be continued. The next one, half that size, is also planned in Rybnik. PGE has also plans to replace its coal CHPs with gas CHPs. These are, among others, the plants in Gdańsk, Gdynia and Kraków to be considered.

Until 2030, 70% of heat should be generated from zero-emission or low-emission sources, i.e. biomass, gas and waste incineration plants.

Distribution is to improve quality parameters, hence the coefficients of power failures until 2025 should be by 8% shorter in big agglomerations and by 50% in other areas. Until 2030 PGE plans to construct 800MW of energy storages. But for it to become successful, “financial stability and development of support for OSD regulation model to guarantee performance of such challenges is required.”

In other words, everything depends either on Energy Regulatory Authority, which can change its current approach to distribution tariffs, or on the Government and the Parliament, which might change the regulations.

No money without strategy

By 2030, PGE wants to invest 75 billion PLN, half of it in renewable energy resources. Thus, the Company is in urgent need of a new strategy, in order to start negotiations with banks. As they do not refuse credits to companies which have coal in their assets provided that they have the strategy for quitting on coal. Since the 19th of October, PGE can boast such strategy. It is only that the performance thereof depends on the Polish Government. And the Government still has not put any significant card on the table.

Unofficial sources claim that NABE, apart from coal power plants of PGE, would include also the power plants owned by Enea, Tauron and Energia, i.e., among others, Kozienice, Połaniec, Łagisza, Łaziska, Jaworzno. The President of PGE, Wojciech Dąbrowski, confirmed that the company was interested in the scenario in which, after such operation, “coal free” assets of both companies would be taken over by PGE. Hence, the market would operate with three dominant entities:

- NABE, to control over 70 percent of domestic productive power, but to sell electricity solely on wholesale market.

- PGE- Tauron- Enea

- Orlen –PGNIG-Energa to focus on new technologies.

Extremely strong concentration would occur particularly in electricity sale to end-customers – PGE-Tauron-Enea with 39 market share, and Orlen-PGNiG-Energa with 40 percent market share. The rest would be left for less significant players. What will the consumers get from such limitations in competitiveness?

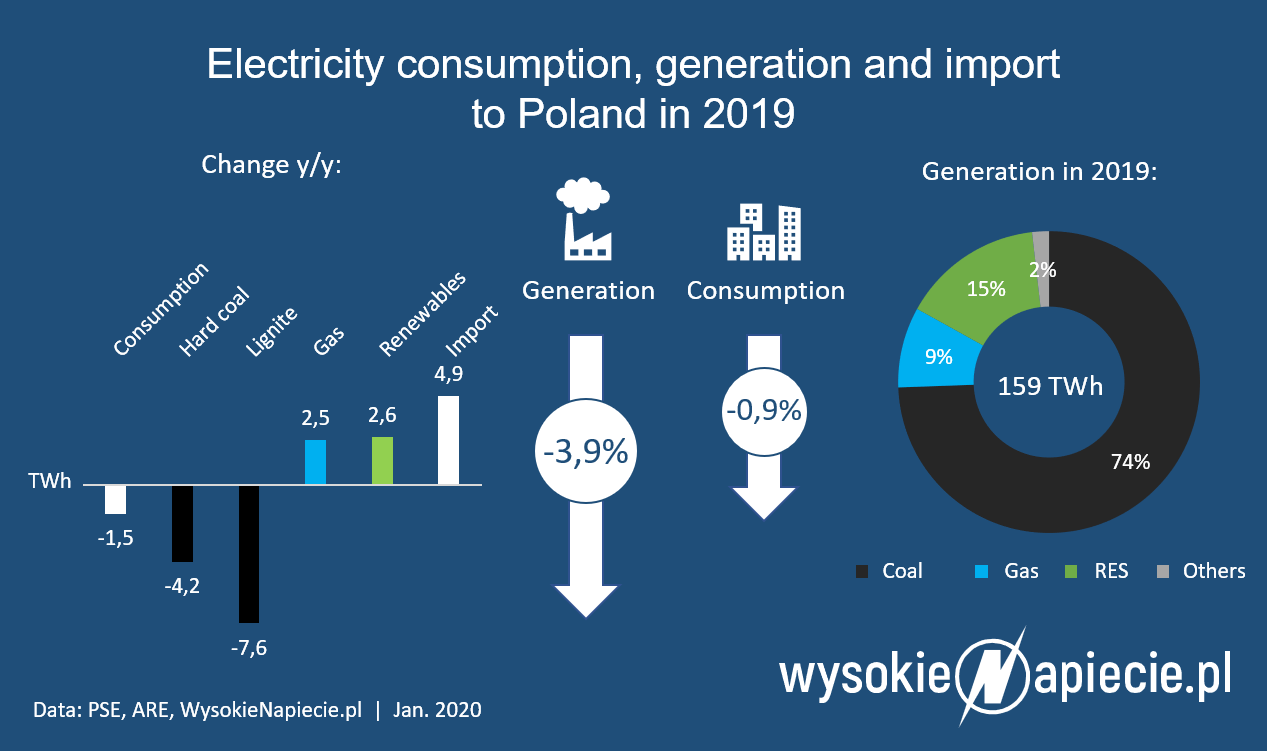

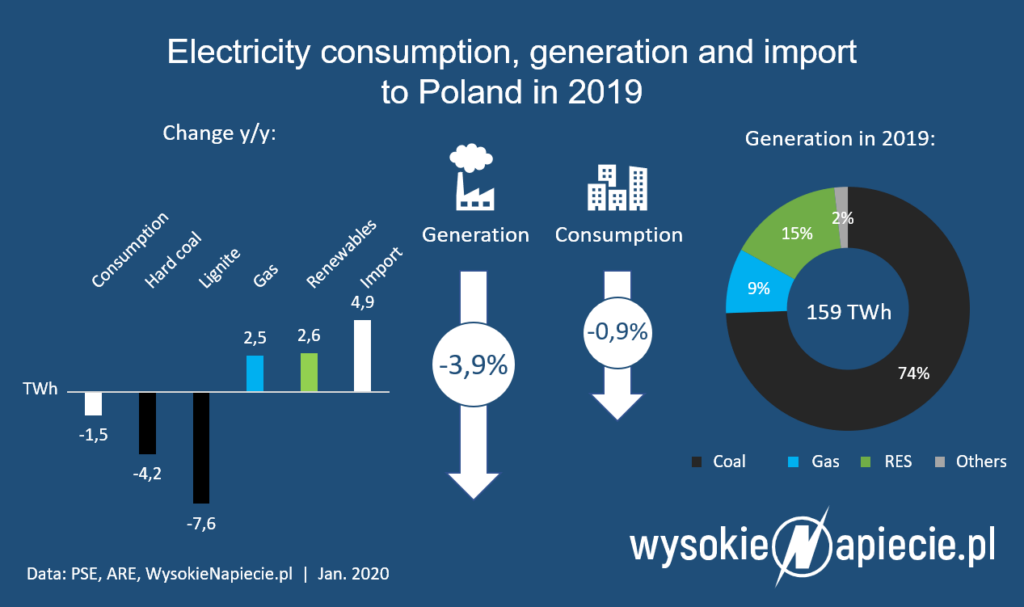

See also: Electricity production lowest in a decade. The smallest share of coal in history

Who will talk to the people?

“Operation of at least part of coal power plants within the next dozen of years (and maybe loner) seems crucial for providing the balance for current power demand in KSE. Removal of coal power plants, assumed in PGE strategy, in the nearest future is the expression of willingness to get rid of a problem connected with their gradual, inevitable shit-down and the intention of cutting off from the connected social issues”, explains former COO of PGE P.h.D. Paweł Skowroński, from the Warsaw Technological University.

What are the issues? Obviously, it relates to the personnel of coal power plants who are not aware of what separation of assets means to them. The labour unions are very reluctant in this respect and threat with protests. PGE can undertake negotiations with labour unions or it can shift the burden to the Government which definitely will make the life easier for the Company.

On the other hand, the Government will not avoid assuming responsibility for transformation including the negotiations with coal power plants’ workers. At the time being it is not an issue though, as there is no final conception ready.

What to do with the debt?

And several key issues are to be decided upon. Firstly, what about the debt. Only PGE has over 10 billion debt against financial institutions, and „Gieksa” owns c. 11 billion to its mother company. PGE would like to zero the debt which means it will resign from its claims against Gieksa but its debt will be relocated to NABE. Will the banks agree? As for now they have not been asked to, but our interlocutors admit it is the key element of the plan. Without further financial securities, the plan will be unlikely for the banks to be approved. After all they borrowed the money to a stable company with 12 billion of EBITDA profit and not to a shelter for dying power plants as NABE will likely to become.

So, it is likely the banks will demand some additional securities. It may be the State Treasury taking over the debt, or a surety; either or, it is state aid which requires the acceptance of the European Commission. The Brussels might agree, but it is likely they will demand a detailed schedule of the end of coal in Poland with detailed plan for closing coal mines and power plants. Here, one needs to repeat for the third time that there is no such schedule whatsoever.

Is PGE’s plan a stable one? Paweł Skowroński has mixed feelings. “Investment plans of PGE in the area of renewable energy resources (2.5 GW in sea wind farms and 3 GW in photovoltaic installations and, at least, 1 GW in land wind farms) in the time-frame of until 2030 may be deemed as real, but ambitious. On the other hand, as the perspective of reduction of electricity generation based on coal has been obvious for many years, it should be pointed out that, considering PGE scale, the biggest electric energy producer in Poland, the volume of projects intended for renewable energy resources should be significantly bigger.

See also: The first wind farms in Poland without subsidies

De-carbonization of heat and power generation and investments in distribution network are good and their implementation into PGE plans must be treated as very positive”, Skowroński continues. However, the declared savings ratio is not so optimistic. “PGE declares improvement of the organization effectiveness and reduction of fixed costs (outside conventional power sector) by 400 million PLN until 2025 and by 800 million PLN until 2030. It is not clear whether these values refer to reduction on annual cost or they imply reduction of fixed costs by 80 million per annum, and in each subsequent 5 years, by ca. 400 million PLN..

Reduction of annual costs by 80 million PLN seems to be significant, however, taking into account the company scale and its current organization condition, the plans for improvement of organizational effectiveness should definitely be more ambitious”- enourages former COO of PGE.

Who is going to arrange the puzzles?

PGE has the strategy which theoretically prompts it towards fast transformation. The Company will have no reasons to unreasonably spend their money on sustaining dying coal mining or waste their time for fruitless analyses of a new open cast lignite mine in Złoczew near Bełchatów. It is a big advantage.

Nevertheless, in practice everything depends on the government which is not able to make fast decisions in the aspects of coal energy. So, we will have to wait for real performance of the strategy. And it is a big disadvantage.

As for now, instead of a single coherent view of transformation we are faced with randomly arranged puzzle bits. We have the draft of Power Policy of the State until 2040, we have PGE strategy, we have an agreement with labour unions of mining industry, we have an idea of separation of coal power plants. But it does not seem to fit into one, single picture. And there seems to be no one to arrange the puzzles.

See also: Poland: government cannot escape the climate discussion anymore